PassEntry

- Company name: PassEntry

- Company size: 11-50 employees

- Industry: Fintech

- Location(s): London, UAE, Spain, Iceland, Vietnam, Brazil, Colombia, USA and Canada

About

PassEntry is as fast-growing fintech business that provides a digital wallet solution that is revolutionising how individuals and organisations manage passes for loyalty programmes, memberships, ticketing and access control.

The challenge

The company wanted to ensure they had the right level of business protection and specific insurances in place as the business scaled quickly.

Part of this growth meant increased operations overseas the need to implement an FX strategy and payment solution for their transactions.

Our solution

As a fellow technology-led SME, we had a unique perspective on Pass Entry’s challenges as they looked to scale.

We were appointed as the sole broker for their insurance and FX needs – saving them significant time and costs in sourcing protection and business insurance.

We completed the process of placing all of Pass Entry’s insurance policies and onboarding their employees to WillU Wallet within four weeks.

Protection

The company wanted to source business protection quickly so appointed WillU as their broker to go to market for them.

We were able to secure the best premiums and most robust terms for their shareholder protection, relevant life and key person cover.

Commercial insurance

As a specialist broker for SMEs, we had a good understanding of the insurance needs that PassEntry had as a fast-growing fintech.

We were then able to go to market and place comprehensive coverage, with a single insurer, to ensure the business was adequately insured for their professional indemnity, employers liability and content and premises insurance.

Health insurance

PassEntry saw the value in consolidating all their insurance requirements through one broker so appointed WillU to take over ownership of their existing PMI policy with Vitality so they could manage all their insurance under one roof.

Pension

A review of the company’s pension scheme found that they were paying high fees and management charges with their previous provider – NEST.

Through our partnership with Smart Pension, we transferred the scheme to Smart and enrolled all their employees whilst they gave notice to NEST.

The company now pays lower charges, and their employees receive greater investment returns on their pension contributions and can manage their workplace pension through the WillU Wallet app.

FX

Having successfully brokered all the company’s necessary insurance, PassEntry trusted us to be their foreign exchange broker as their operations grew abroad.

With clients and suppliers based all around the world, the company needed a strategic partner to manage their long-term foreign currency exposure and protect their profit margins.

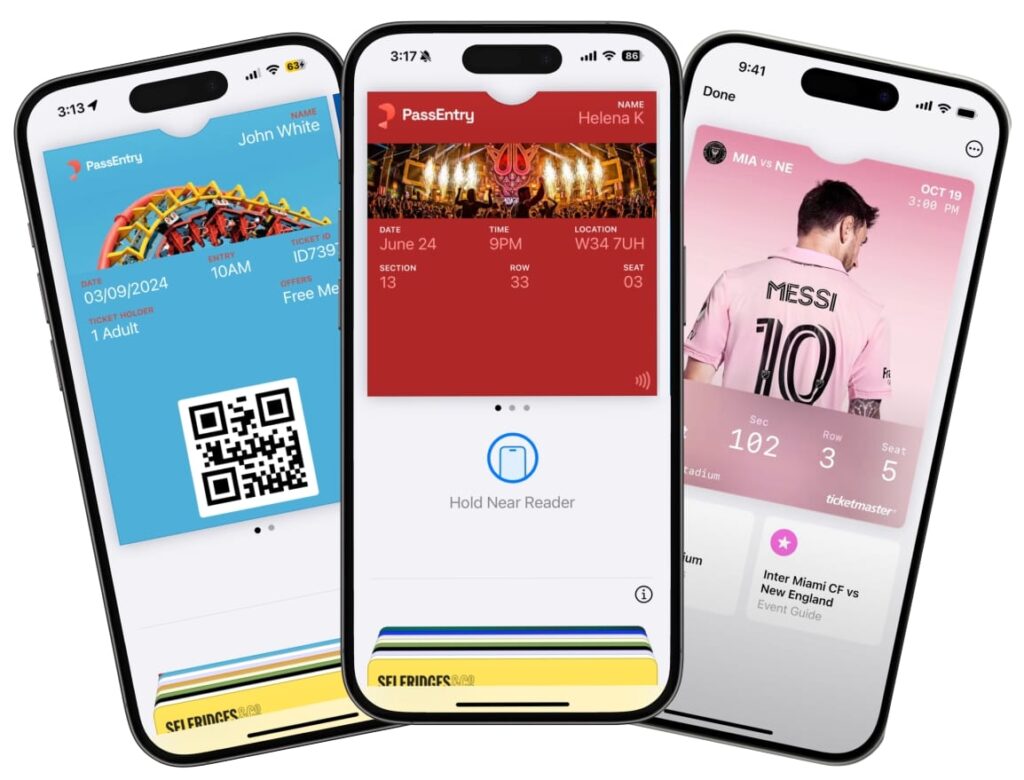

WillU Wallet

Central to setting up all these core policies and benefits was the WillU Wallet app.

Through WillU Wallet their HR team can access crucial data, including insurance cover notes, protection policies and their FX accounts, all in one place.

Their employees can use it to make claims on their health insurance and manage their pension. The app also gives employees free access to WillU World, our employee rewards platform, that offers discounts and promotions from hundreds of leading brands.