Highview Group

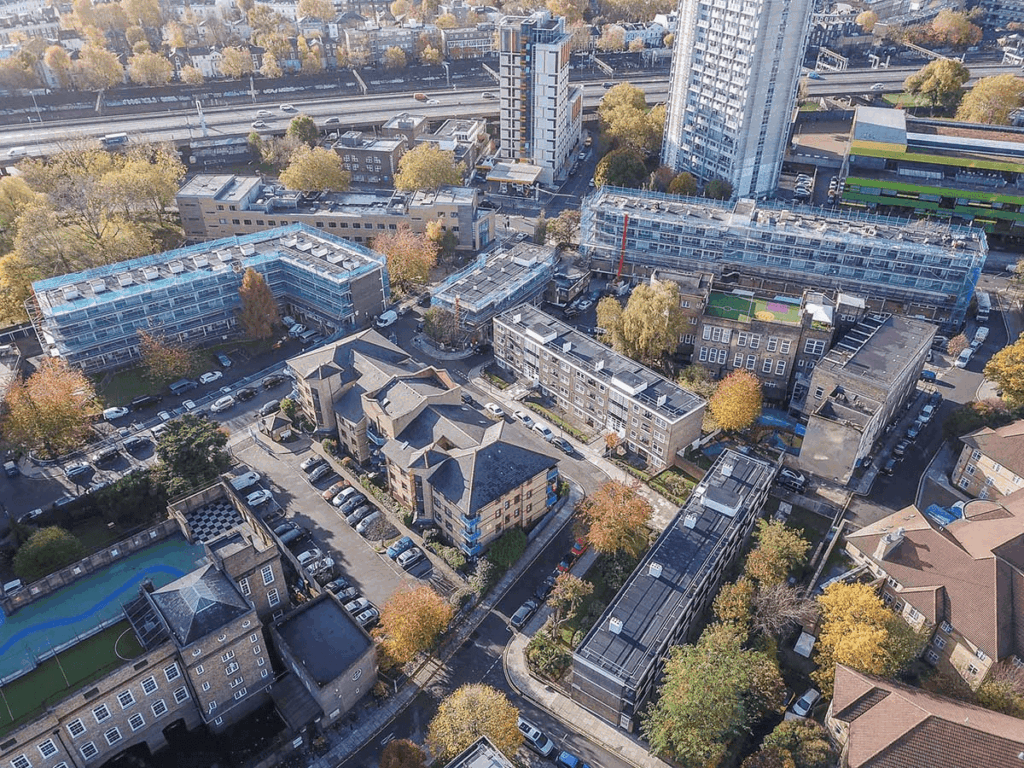

- Company name: Highview Group

- Company size: 30 - 50 employees

- Industry: Construction

- Location(s): UK-wide

About

Highview Group is a specialist construction company delivering high-end residential and commercial projects across the UK.

Known for their commitment to quality and craftsmanship, Highview values a healthy, motivated team and a strong leadership structure.

The challenge

As a growing construction business, Highview Group wanted to enhance its employee benefits package to reflect its values and better support its team’s wellbeing and financial futures. However, managing these benefits had become time-consuming and piecemeal – with legacy arrangements, inconsistent coverage, and limited engagement across the workforce.

The directors were also keen to ensure their own protection planning was fit for purpose, with appropriate succession and estate planning in place.

Our solution

We worked closely with the company’s leadership team to deliver a comprehensive employee benefits and financial planning solution tailored to the company’s needs and culture. This included:

- A full review and switch of their private healthcare provider to reduce costs

- The introduction of group protection for staff and business protection for directors

- Pensions and estate planning support for senior leaders

- The rollout of WillU Wallet to engage employees across the business

Health insurance

Highview Group’s private medical insurance scheme had become expensive and no longer represented good value for money. We conducted a full market review and successfully brokered a new policy with a leading provider – securing improved cover for employees at a lower premium. The switch was seamless, with no disruption to staff benefits.

Business protection

We introduced a comprehensive suite of protection policies across the business:

- Death in Service (via YuLife): cover for all employees and directors. The gamification in the YuLife app incentivises physical activity and wellbeing, improving staff engagement with the new benefit from day one.

- Shareholder protection, relevant life cover & key person insurance: Tailored policies to protect the business against loss or illness of key individuals, providing peace of mind and security for directors and stakeholders.

Wills, LPAs and Trusts

We helped each director put in place personal Wills, Lasting Powers of Attorney, and Trusts – ensuring their personal and professional affairs are structured in line with long-term wishes and succession plans. These arrangements also supported the wider business continuity planning.

Pensions

Highview’s workplace pension scheme was moved to Smart Pension, a modern, digital-first provider. This made it easier for staff to access and manage their pension savings, increasing transparency and boosting engagement across the workforce.

WillU Wallet

To bring it all together, we implemented WillU Wallet, giving every employee access to their benefits, pension, protection, and financial wellbeing tools in one easy-to-use app. This has simplified communication, improved transparency, and empowered staff to take control of their finances and benefits.

long-term success.”